July 3, 2025

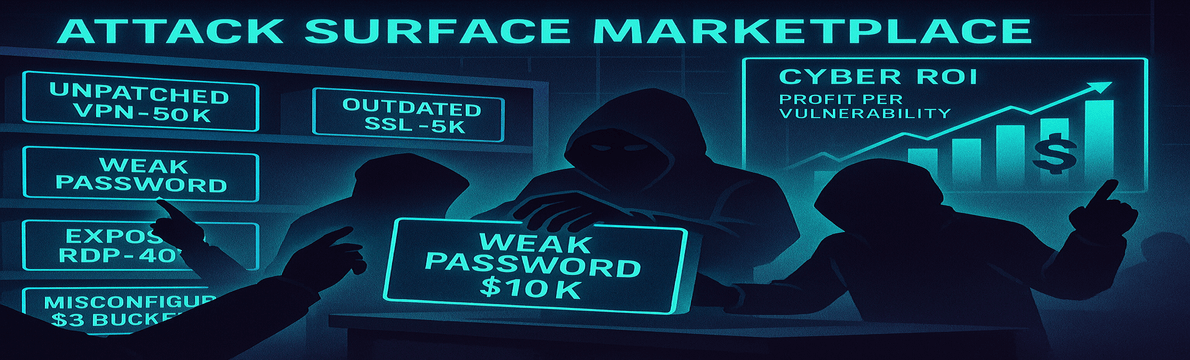

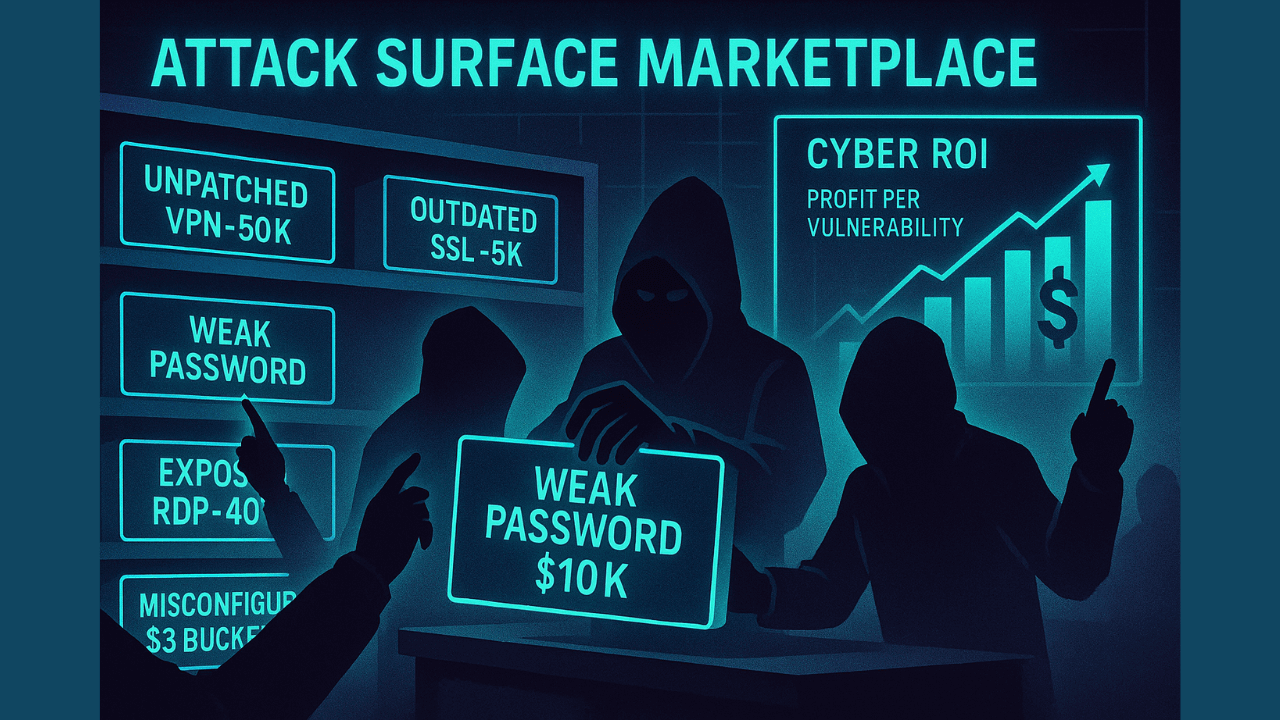

In a world where ransomware is a business model, and data breaches are priced like commodities, your attack surface has a market value—even if you don’t know what it is yet.

Threat actors already do the math: What would it cost them to breach you?

But the real question security leaders should be asking is:

What does it already cost you to not know the answer?

AI-driven Cyber Risk Quantification (CRQ) is now giving organizations the power to reverse-engineer that logic—turning abstract technical risk into hard financial numbers that boards understand, investors respect, and attackers fear.

Cybercriminals think in terms of ROI.

They assess organizations not just for weaknesses, but for profitability. Low effort. High reward. Repeatable playbooks.

Two examples underscore this economic model:

Attackers measure your value before they strike.

Why aren’t you doing the same—from the inside out?

Enterprises with weak or absent cyber risk quantification often overspend in the wrong areas—and underinvest in what actually matters.

Key symptoms include:

A Fortune 500 financial institution recently used AI-powered CRQ to map the business value of assets and their risk contribution. They found that just 5% of their exposed assets accounted for 85% of their potential financial risk. By redirecting their efforts, they reduced modeled risk by $2.3M in six weeks.

This is the hidden cost of not knowing what it’s really costing you.

The future of CRQ is here—measurable, actionable, and powered by automation and GenAI to drive decisions that align with your business goals. Get a Balbix CRQ demo here.